Here are PUBLIC posts related to Medicare Agent Training.

For the good stuff, see membership information: click here.

Med Supp Carrier Stealing Clients - Important to Know| 12-22-22 Meeting

2022-12-25 12:22:54Post-AEP Wrap, including the January through March opportunity of MAOEP and more.

See meeting notes under the video:

- Gather Post-AEP Feedback in a form for next meeting..

- MAOEP Starts January 1 through March 31 – effective is first of the next month

- General Enrollment Period for 2023 means first of the next month.

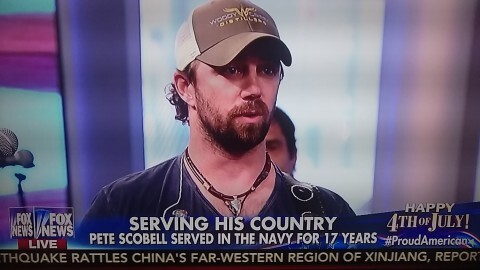

- CIGNA is stealing our clients – spouses, when clients call in, etc.

- Broken equipment, super slow startups, things not working? Please send Chris an email.

Locking computers when leaving your workstation – tell me all going on. Cleaning crew video: https://youtu.be/SzJH6lLAa6M

Click here to read on

Click here to read on October 24 '22 Internal Meeting - AEP Tweaks & Fixes

2022-10-25 12:13:10AEP Appointment management, handing the PDP and MAPD appointments ahead of time and managing expectations with clients when you have too few appointment spots for AEP. These and more topics during the height of AEP.

See meeting notes under the video:

Notes:

- Not everyone needs an appointment.

-

-

- Look for a reason NOT to schedule. Treat the schedule like there’s only one appointment left. If that were the case, would you schedule it?

- Current Client- look at their renewal day. Check the notes for the last time we reviewed their plan. They likely do not need to do anything other than use M.ID. (StartParttD.com)

- Did they see the AEP update email? No? Resend and ask them to take a look.

- Leads- MAPD have to emphasize that we need the doctor/drug info or we cannot help them in the allotted time.

- Booking so far out, we are losing people to competitors before they even get to talk to one of our agents.

- We need to reassure them that we have plenty of time

- We need to make sure we aren’t booking unnecessary appointments, so we don’t have so our availability is more manageable, and you don’t have so many people shocked by the earliest appt date.

- Unnecessary appointments also take money from the agent’s pocket. They could have been talking to someone they could help. They are very kind generous people, but they also work to make money. Let’s help them do that. Someday you may be the one in their seat.

- New Lead VM – starting to pile up. Let's start getting a text to everyone on the sheet first. Then we can reevaluate through for calls. Hopefully, some of the leads will have already booked an appointment by the time we cycle through for the call. (This is not our normal procedure, but we have to switch gears due to volume.)

- Agents: MAPD → Med Supp

- SUPER Important that you indicate “MAPD to Med Supp” under “Special Circumstances” on the Client Sheet. This triggers the progress to start tracking whether or not they get a PDP.

- PDP Appointments – We need to send people with NO MEDICATIONS to SPD.

- People coming off of an MAPD need to get a Drug Plan (PDP) to kick them off of said MAPD. Our agents need to have availability for these people to make sure they do everything correctly to get off of the MAPD.

-

- MAPD / PDP Customer Response Sheet

-

- It is easier to input submissions as they come in rather than letting it build up and only working on entering information into LAPRO and Radius the day before the appointment.

- Once you have updated LAPRO, Radius, and Google Calendar, then you can add that little asterisks to the “title” of the appointment in Google Calendar.

- Even though clients have medications in LAPRO already, you still need to compare them to what they submit for 2023.

- The best way to do this is to uncheck all boxes next to the already listed medications in LAPRO and then re-add them based on the submission document.

- Fill in each cell in the response sheet as you go so that you don’t miss any medications AND anyone else working on the sheet can see that you are actively working on this and won’t work on the same client at the same time.

- If the client has medications that have multiple listings in LAPRO and the client did not submit the very exact information for a medication – please add something to LAPRO as a spot holder/place keeper, so the agent doesn’t have to fool around with spelling, etc and make a note of that in the client’s Radius.

- Please do NOT add any personal information such as medications to the calendar. If you make a note to review Radius before the appointment, and add those notes in Radius, you are setting the agent up for a successful and easier appointment.

- Overtime – Let's ensure we are not clocking in to clock in. Seeing many hours with nothing happening is not what OT is for.

Click here to read on

Click here to read on Centene Banned From Growth Due to Horrible Scores

2022-10-10 14:56:35Centene has been banned from expanding its Medicare Advantage plan due to consistently-horrible scores in the federal quality rating program.

According to the Modern Healthcare article, “Among large insurers, Centene fared the worst in the rating program this year. Just 3% of its members are enrolled in plans that meet the four-star quality bonus threshold for 2023, down from 54% last year…”

This is no surprise to agents who have been writing Wellcare/Centene is the past few years.

“They had immense volumes of mergers and acquisitions and immense amounts of integration work.” – the Modern Healthcare article says.

The entire article can be found here: https://bit.ly/centeneban

Wellcare in the news as of October 10, 2022 includes:

Click here to read on

Click here to read on December 6 End of AEP Meeting

2021-12-07 03:01:57One day left in AEP – the information needed to get us across the finish line!

See this internal office meeting video below:

See the video:

Internal Agency Meeting Notes

Hannah

- CRUNCH TIME – final sprint.

-

- Use every resource we have to get back to people as efficiently as possible.

- Text/email WORKS

- Don’t let people waste your time. We have to compress phone calls as short as possible right now. We’d love to chat another day but have to make sure everyone is taken care of FIRST.

- Hold all non-AEP-sensitive tasks until Dec 8.

- Need the PDP appt needed sheet to be a top priority. Need to check every single one of those and reach out to anyone who hasn’t replied to us yet.

- We Will have a list of people who need to complete their AICOEs shortly – need a volunteer to call/text those people.

- If someone is being overtly rude, take control and give them one chance to turn it around, then we are done.

(I’m not talking about frustrated or confused people, I’m talking about people being straight-up nasty.- I’m not sure if you were raised to think it was ok to tell someone to shut up, but please be respectful to me and my time. I am just trying to help you as you asked.

- Or, please don’t interrupt me while I’m trying to answer the question you asked, and I will be respectful and make sure I provide the same courtesy to you.

- If they continue to be nasty, we can refer them out or simply tell them we are not a good fit.

Chris

- Federal Life – why are we not writing?

– Better rates in MANY states

– Mutual of Omaha E-App and Customer Service

– Blue Button Integration with LIVE support available

– Warning – there is an Application Fee that is not disclosed on the Application (Fix coming) - New Radius Leads and Clients – Please put primary/only phone under Cell spot – ask if they can receive texts – this is our future and has been SUPER helpful during AEP!

- “Leave Us A Review” – Take this out of all templates where we have not delivered for the person. All quoting, back and forth e-mails, fixing problems, etc. ONLY when we have had a positive experience with a person all the way through. We are sabotaging our success here with 2 close calls in the last week.

- CIGNA UW cases – make sure they do the phone interview on their own. Don’t wait for the company to call.

End of AEP – trying not to lose the people panicking when 12/7 means NOTHING to them.

At least deliver this information to everyone we can as quickly as we can. Lost a lot last year who just simply called the bored agent who was sitting by the phone.

Click here to read on

Click here to read on WARNING: For those recommending GOODRx

2021-09-15 12:46:04If you have been recommending that your senior clients utilize GoodRx for determining the best local source for their drugs, this is something you will want to know.

GoodRx has entered into an exclusive agreement with GoHealth to provide Medicare plan information and marketing to all GoodRx users.

This means that, for every person you have referred to GoodRx, they are now being marketed through that platform to get their Medicare insurance needs now met through GoHealth.

Here is the press release – click here.

We will have a solution for our agents and members to this situation very shortly – stay tuned!

Click here to read on

Click here to read on Ameritas NEW Product Sneak Peak

2021-06-29 14:48:57Ameritas was at our LIVE event in Charleston and announced new product offerings that will start in July, 2021.

Here is the video:

If you do not yet have Ameritas and want to get it, click here.

Click here to read on

Click here to read on Medicare Rights Center Asks Biden For Medicare SEP - OPEN UP!

2021-02-11 17:53:24The Medicare Rights Center signed onto a letter, along with all 50 state and national organizations urging the Biden Administration to open a Special Election Period for Medicare beneficiaries for Part C (Medicare Advantage) and Part D (drug plans.) The administration did so in January for those Under 65 but neglected to address those most vulnerable to the effects of Covid – the senior population.

In part, the letter reads:

Specifically, we request the immediate reinstatement of two critical COVID-19 related Medicare

enrollment flexibilities: the Special Enrollment Period for Part C and Part D2 and Equitable Relief for

Premium Part A and Part B.3 These policies should remain in effect through December 31 of the year the

public health emergency ends, at a minimum, and coverage should begin no later than the first day of the

month following enrollment.

We call on the agent community, including NAHU and AHIP to advocate for this re-opening, too.

https://twitter.com/nahusocial

Click here to read on

Click here to read on Be VERY Careful Here, Please

2020-08-27 11:24:46There's a bit of a conundrum, a dichotomy, if you will, in the sales world, where you have to be ambitious, you have to have a go getter attitude.

And you cannot be easily dissuaded and give up before you start having progress.

At the same time, though, there is such a thing as a person with too much ambition. Let me explain. Had a person working for me, who was very ambitious, wanted to be on the leaderboard, wanted to be highly productive, and did everything this person could do to write as many policies as possible.

Sometimes, when blinded by an unhealthy dose of too much ambition, a person can start to take shortcuts, a person can start to forget to do things that are otherwise impediments to doing more business. And by forgetting to do things I mean, in this case, for getting to ask health questions on Underwritten application, just first, a little bit here and a little bit there, like when the application for health insurance asks,

“Who's your current doctor?”

“What are your current medications?”

And this person, you know, answers all the health questions on the application, but then leaves out the doctors then leaves out the drugs or just put someone and then come to find out starts answering, or asking less and less and less questions of the client.

Why?

Because when you ask all the questions appropriately, sometimes not everyone is going to get approved. So what does that mean? If you're blind ambition is to an unhealthy level, it starts making a person who has less integrity than they should to be in this business, to be literally responsible for someone's health or not to get a procedure paid for or not simply because a person in a capacity of as an agent lies on an application.

Now, is it a lie or is an omission?

I would argue it makes no difference. If someone tells you “YES” to a question on diabetes with complications, for example, and you click “NO”, they've got diabetes with complications. And you put No, that's a lie. If, however, you don't even ask the health questions. That is an omission. It's the same thing as a lie.

If someone went to four specialists in the last three months, and you omitted all that information, and you submitted that application, as if it's the factual upon which the basis of the insurance company will decide whether or not to give that person coverage, or then later to potentially exclude coverage because they identify a material omission on the application, then for all intents and purposes, the agent lied.

Now, why did the person choose to do this? Because they had to have that next sale, had to have that next application.

The reason why insurance companies check the credit of the agents that their contracting is because they know that if your credit score is too bad, then the agent gets too desperate and they start doing shady things bad business. That does happen all the time. So we have to look out for in our industry that we don't get too hungry, that we're willing to do absolutely anything to get the business because there's a healthy balance between doing the right thing for the client, for the carrier and for yourself. And when you start blurring the lines when you accept a little bit of dishonesty, it gets easier and easier and easier.

I challenge you my fellow agents in the community maintain an impeccable credential and reputation.

The Bible says that a reputation is very hard to get. And it's a very valuable thing, a good reputation.

Proverbs 21:22 A good name is to be chosen rather than great riches, and favor is better than silver or gold.

And it's true. And all it takes is one accusation, one client making a complaint to the Department of Insurance. Or one case, in our case of an agent being terminated for cause for lying on an application that then by our state law, we are then obligated to report to the Department of Insurance. We have to, if an agent is terminated for cause for lying on an application could ruin a person's life. And it's really not worth it. If you do everything with integrity, sooner or later, that's going to catch up with you.

If you do everything without integrity, and you take that slippery slope, and you go that easier route easier, easier, easier.

You start asking less and less questions on the application. On a life insurance question I've literally heard an agent say

“All I need for the life insurance application is who your beneficiary is.”

No, that's not all you need. It's really not.

Because you're purporting to fill out an application based on 30 health questions or something. So it gets easier and easier to lie, cheat and steal, just for the sole purpose of getting a commission that I would argue you have to fight every day to maintain your integrity, don't even let it in. Don't even let a glimpse of it in not even a blip. Not even one little thing that a person Oh, I forgot to ask that question. I'll just go ahead and wing it. I'll do I'm sure it'll be fine.

Luke 12:2 “There is nothing concealed that will not be disclosed, and nothing hidden that will not be made known.”

That's true. And if there becomes a certain pattern, like we saw in this situation, and we go back to another one and another one and another one, and they can see literally a pattern of getting worse and worse and worse.

So I encourage you to go forward with integrity.

There's plenty of business, there's plenty of healthy enough people out there.

There are plenty of people out there who are going to give you referrals of other good people like them. If you keep on pressing toward the mark of doing things with integrity, there's enough business, you'll do it the right way.

You don't need to take shortcuts and you don't need to look for the magic pill. The magic pill is hard work.

It's talking to enough people. It's sorting the people like you're supposed to, because you're representing not only the client, but also the insurance company. And if everybody was just out there willy nilly answering all the questions no or never even asking the questions in the first place, insurance itself would be unaffordable for other people to buy. We have to set a higher bar in our industry so that we, as insurance professionals, get and then maintain higher reputation than we enjoy right now.

Click here to read on

Click here to read on Hiring for Medicare Agents? Wait Just a Minute...

2020-06-05 09:13:14Making over $150 to up to $300 per sale (the difference between what the agent will make) is a HUGE incentive to push Medicare Advantage vs. Medicare Supplement.These new agents are discovering that they have been misled, or at least, left out of the education about the alternative to keeping Original Medicare and using a Supplement plan to fill in the gaps. Be careful when looking for Medicare sales Jobs on Indeed! See the video:

Click here to read on

Click here to read on Corona Virus, Hurricanes, Snow and Seniors

2020-03-05 18:36:14The insurance industry has, for the past 15 years at least, been moving faster and faster toward telephone transactions only.

Whether it is hurricane season, snow-blocked roads, or spreading viruses where seniors are most vulnerable, seniors would much rather NOT have you come inside their home in 2020 and beyond.

More than ever before, seniors are more likely to trust a licensed agent on the phone and the difficulties of the 1990's in this arena have almost completely disappeared.

Where, in the past, insurance agents would need to scramble to create trust and credibility as to the process of conducting business by phone, today it is completely normal, even for seniors, to conduct all financial transactions by telephone and online. Insurance is no different.

With all of the insurance companies now offering easy online enrollment tools for agents, most not requiring a signature of any kind, it has never been easier to run our business 100% over the phone.

Our internal agency has been growing in leaps and bounds and there is no stopping the growth.

Companies like E-Health, Spring Venture Group, and many others have created call centers up to 1,000 agents sitting in one building doing enrollments over the phone all day, every day.

The number of products and services now being offered 100% online means that agents must make a choice: Either be limited by travel, distance, and physical constraints of how many clients you can help in a day or be unlimited by using the telephone, a headset, and simply-scalable office helpers who can continue to grow your enterprise without experiencing rain, sleet, snow, hurricanes or yes, even pandemic viruses!

While many FMO's (Field Marketing Organizations that sell insurance products) continue to spend 99% of their time pushing contracts onto new agents, there is one organization that has existed since 2013 with the sole purpose to share real, actionable intel to agents from being an actual practitioner… An organization that actually sells insurance to the senior community each and every day and actually shares what they've learned and what is working on the site: Medicare Agent Training.com

So, while pushing contracts is not the goal of this organization, top-level contracts are available via SellMedicareByPhone.com Actual agent success is why this site exists and it is knowledgable support that has made the difference in the lives of countless agents in the site's first 7 years of existence.

Near-24 hour support on how to issue the right case to the right client at the right time with the right product and carrier exists via immediate-response support tickets on the MedicareAgentTraining site for members.

This feature, alone, has saved thousands of client acquisitions for agents who simply did not know what they could do in particular situations, often involving unique special election periods that their prospective client could qualify for. And yet still, the contract-pushing FMO's know nothing except what new company is offering what bonus, and what they have been told to push, by management.

Updates from industry insiders are provided to site members.

These are updates from top producers, not contract pushers or seminar promoters.

“Do as I do, not as I say.“, is the motto at Medicare Agent Training.

We help agents to effectively communicate to seniors and efficiently deliver the right product from the right carrier at the right time.

Seniors don't want you at their front door.

They don't want to get dressed up, put the dog away, or offer you something to drink.

They do it because it is polite. But driving to their house, confirming they are home, knocking on their door, even putting gas in your car to do all of the above – complete unnecessary waste of time.

They want their problem solved in the easiest way possible, and that is by phone.

Click here to read on

Click here to read on Be Careful of Fake News in Insurance Agent Promotions

2020-02-24 17:11:03The internet is abuzz with promotion after promotion toward agents. Everyone calls themselves an expert these days with the goal of recruiting more agents to follow them like the pied piper. <

Click here to read on

Click here to read on I just got YELLED at!

2020-02-07 15:27:21

I just got yelled at by a client. It was not one of MY clients, but another agent for “forgot” to tell her new client that they would also have to cancel their OLD Medicare insurance policy now that they have gone to her.

The importance of checklists, when selling insurance, cannot be overstated. Without one, sometimes we forget each and every detail that MUST be effectively communicated to the new client. Forgetting just one can have tragic financial consequences for the client.

See the After Application Checklist on the Tools You Need page.

See the video:

Click here to read on

Click here to read on How to Fail in the Insurance Business

2020-02-03 14:03:08

Click here to read on

Click here to read on Proving Telephone Sales with Online Leads is Viable

2019-06-04 12:56:05Spring Venture Group is an Icon

With their main location in Kansas City, Missouri, Spring Venture group now has over 700 agents in their building. They are expanding into other locations and soon will be over 1,000 agents, all selling Medicare products all over the phone. How? They are creating their own online leads and they are converting those leads into new customers.

Why is this working?

The business model of selling Medicare products over the phone is not new anymore.

Several folks, like Richard Cantu, who sold his GoMediGap.com phone-sales agency for nearly $50 Million to E-Health with the same business model, and Chris Guliani of Spring Venture Group have proven that this concept of online lead generation to telephone sales conversion works on as big of a scale as you would want to grow.

I had a chance to meet with Chris Guliani (SVG's CEO) in 2018 on a carrier trip to Portugal:

Actually, Richard Cantu was there, too, as was Jagger Esch of MedicareFAQ, another hugely successful phone-based Medicare agency in Florida who also uses online advertising to great success, and Taylor Martin of Senior Security Benefits in Texas, another super-successful phone-based insurance marketing organization in Texas.

The conversation on the beach that day, and throughout the trip, was centered around how thankful we were to have, first, found this industry and second, to have found it in a day and age where technology has allowed us to be more successful than any other generation prior. Chris Guiliani and I brought our children on the Portugal adventure. This was our daughter's first trip out of the country and they were amazed.

The use of the telephone, first invented in 1876, to move the insurance industry forward by enormous leaps and bounds starting in the 1990s, coupled with digital marketing for lead generation in the 2000s means that we are at the right place, with the right set of products, at the right time.

Sprint Venture Group, EHealth, GoMedigap, MedicareFAQ, Senior Healthcare Direct (aka “MedicareBob”), BoomerBenefits, MedicareMedigapDirect, and countless other phone-based agencies who generate their own leads using online platforms all prove that this is the market to be in.

Each and every one of these agencies started as a single producer who had the vision to grow what works, to scale. Many of them have taken on partners to grow even faster. Having made friendships with these agency owners, I have been truly inspired by their success and even more motivated in the knowledge that if it can be done, I, too, can accomplish anything I want to in this industry – using a telephone.

Christopher L. Westfall, Sr.

MedicareAgentTraining.com

Click here to read on

Click here to read on Medicare For All - What About Agents?

2019-05-23 12:09:50 Click here to read on

Click here to read on Trouble Getting Personal Information with Telephone Sales

2018-12-31 12:40:01(Public Post)

Are you regularly struggling with objections when it comes time to get personal information for an application when selling by phone?

I saw a question posted in an online forum where an agent was continuing to have objections when asking for the client's Social Security Number on the application.

The problem is ALWAYS trust and credibility.

If you at the application and then you discover there is a trust issue, it is a systemic problem with your overall presentation.

The trust and credibility should be firmly established very early, and often, in the presentation. It can never be skipped.

In fact, they will hear NOTHING of the particulars of the product or solution you are proposing if they do not, first, have the framework of trust and why they should be listening to YOU in the first place. They are bombarded, everywhere, with public service announcements saying that seniors should never give out their personal information over the phone. And they shouldn't.

What makes YOU different and worthy of receiving this information? THAT is the question going on in their head, the whole time you are talking.

We cover this extensively on this members-only page:

https://medicareagenttraining.com/training_modules/selling-100-by-phone/

See the video:

Click here to read on

Click here to read on Question 4: Can I Get Insurance Contracts with Poor Credit?

2018-07-16 16:00:49Bad credit does not, necessarily, preclude you from selling insurance.

Watch the video!

Click here to read on

Click here to read on How to Select an FMO for Medicare Sales

2018-06-09 19:52:58Here, in this real call I received from an FMO recruiting operation, you can hear some good questions you should be asking before you are contractually obligated to an FMO.

See the video, then the tips underneath:

Questions to ask:

- Full commission. This means nothing short of the same the carrier offers, directly.

- Release upon request. The top FMO in the country DOES NOT offer releases, ever. Find out.

- Actual sales experience in the market.

(An insurance license is easy to get. How much success have they had actually selling, personally?) - Availability during YOUR sales hours.. Do you speak with clients after hours? Weekends? When is YOUR upline available?

Bankers hours, only? When will they get back to you on actionable intelligence to help close the sale? - How many “President's Club” and Carrier Awards trips has your immediate upline been on? What does that mean or not mean?

- Relationship with carrier reps who know what products are coming, where, and when.

Would you like to discuss where your contracts are? Write to: [email protected] anytime.

Click here to read on

Click here to read on Technology when selling by phone

2018-04-25 09:58:17A very painful lesson, trying to get work done while they're waiting for us at the next party!

Having the right tools, when you need them to work NOW, makes a big difference in overall productivity.

Your business deserves to not have to wait for pages to refresh, videos to render, and crashes when multi-tasking!

Click here to read on

Click here to read on What vehicle are you riding for Medicare sales?

2018-02-04 19:19:14 Click here to read on

Click here to read on Chris Westfall Interviewed About Medicare Supplements

2018-01-30 22:00:13David Duford, of DavidDuford.com, did an interview with Chris Westfall about the Medicare Supplement business. This interview was conducted in December 2017, but released on Youtube January 30, 2018.

CMS: Errors continue to plague Medicare Advantage plans' provider directories

2018-01-29 08:57:14by Leslie Small | FierceHealthcare

Medicare Advantage organizations (MAOs) continue to do a poor job of maintaining accurate provider directories—and it’s landing some in hot water with the federal government.

In its second round of online provider directory reviews, the Centers for Medicare & Medicaid Services found that 52% of the provider directory locations listed had at least one inaccuracy.

Those errors included providers who weren’t at the location listed, providers who didn’t accept the plan at that location, providers who weren’t accepting new patients despite the directory saying that they were, and incorrect or disconnected phone numbers.

When CMS conducted its first review of MAOs’ provider directories, it found that 45% of locations listed were inaccurate. While the report does say that the first and second reviews aren’t directly comparable “due to minor updates to the review methodology,” at the very least, the latest review’s results indicate the problem isn’t getting any better.

CMS also noted that its findings were not skewed by a few organizations but instead were widespread in the sample reviewed, which was about one-third of all MAOs. “Very few organizations performed well in our review,” the agency said.

At a minimum, provider directory errors can make members frustrated with an MAO, the report noted. But they can also cast doubt on the adequacy and validity of the MAO’s network as a whole, and even more seriously, prevent members from accessing services that are critical to their health and well-being.

RELATED: Study takes stock of MA hospital networks

Based on the results of its reviews, CMS has sent 23 notices of noncompliance, 19 warning letters and 12 warning letters “with a request for a business plan” to Medicare Advantage insurers.

However, the agency emphasized that MAOs themselves “are in the best position to ensure the accuracy of their plan provider directories.” It also said it was encouraged by pilot programs aimed at developing a centralized repository for provider data that would be accessible to multiple stakeholders.

In the near term, CMS added, MAOs should perform their own audits of their directory data and develop better internal processes for members to report errors.

See the original article here:

https://www.fiercehealthcare.com/cms-chip/medicare-advantage-provider-directory-errors-network-adequacy

Click here to read on

Click here to read on Monthly Bank Draft or Pay Annually for a Medicare Supplement?

2018-01-10 12:29:34The question we often get, “Should I pay annually for my Medicare Supplement?”

Often times, seniors think they'll get a discount for paying annually. Well, with Medicare Supplements, they do not. Life insurance? Maybe, depends on the carrier, but NOT with Medicare Supplements.

There is a HUGE downfall to paying annually, in fact, with a Medicare Supplement, and this is something your clients MUST KNOW.

See the video.. the dangers of paying annually (or quarterly) for a Medicare Supplement:

Wordpress Sites Under Attack

2017-10-19 13:03:04October 19, 2017

A recent warning by the security experts at Wordfence indicate a higher-than-normal amount of scanning of WordPress sites by hackers looking for SSL security key information. If stored incorrectly, private key information on your server could easily expose your site to exploitation and that can be the loss of business.

Here is a link to the Wordfence warning and this is the tool they recommend to scan your site to see if it is vulnerable right now.

Ironically, just two days ago, Chris Westfall made a post on how to not only secure your website for upcoming Google loss-of-search prevention but a way to do it free and easier than installing your own SSL security certificate (which is a huge pain). To see that secure post, click here: https://medicareagenttraining.com/tip-website-must/

Click here to read on

Click here to read on New Medicare Cards for 2018

2017-09-15 05:43:55The new Medicare cards are here. What do you do when you're writing a Turning 65 (T65) person and they do not have their new, cryptic, Medicare card number yet?

That is covered here: https://medicareagenttraining.com/march-2018-medicare-update/

CMS Reveals New Medicare Card Design

- Date

- 2017-09-14

- Title

- CMS Reveals New Medicare Card Design

- Contact

- [email protected]

CMS Reveals New Medicare Card Design

Removing Social Security numbers strengthens fraud protections for about 58 million Americans

Today, the Centers for Medicare & Medicaid Services (CMS) gave the public its first look at the newly designed Medicare card. The new Medicare card contains a unique, randomly-assigned number that replaces the current Social Security-based number.

CMS will begin mailing the new cards to people with Medicare benefits in April 2018 to meet the statutory deadline for replacing all existing Medicare cards by April 2019. In addition to today’s announcement, people with Medicare will also be able to see the design of the new Medicare card in the 2018 Medicare & You Handbook. The handbooks are being mailed and will arrive throughout September.

“The goal of the initiative to remove Social Security numbers from Medicare cards is to help prevent fraud, combat identify theft, and safeguard taxpayer dollars,” said CMS Administrator Seema Verma. “We’re very excited to share the new design.”

CMS has assigned all people with Medicare benefits a new, unique Medicare number, which contains a combination of numbers and uppercase letters. People with Medicare will receive a new Medicare card in the mail, and will be instructed to safely and securely destroy their current Medicare card and keep their new Medicare number confidential. Issuance of the new number will not change benefits that people with Medicare receive.

Healthcare providers and people with Medicare will be able to use secure look-up tools that will allow quick access to the new Medicare numbers when needed. There will also be a 21-month transition period where doctors, healthcare providers, and suppliers will be able to use either their current SSN-based Medicare Number or their new, unique Medicare number, to ease the transition.

This initiative takes important steps towards protecting the identities of people with Medicare. CMS is also working with healthcare providers to answer their questions and ensure that they have the information they need to make a successful transition to the new Medicare number. For more information, please visit: www.cms.gov/newcard

###

Get CMS news at cms.gov/newsroom, sign up for CMS news via email and follow CMS on Twitter @CMSgovPress

Click here to read on

Click here to read on The Importance of Building a Team

2017-08-23 08:30:59Getting Calls Answered - Multiple Solutions

2017-06-05 12:00:52Are you having a difficult time getting your prospects to answer your call when you are calling them back?

This is very often due to the fact that you are calling from an area code outside of their service area. One study showed that you can increase answer rates by 40% by using local Caller ID. Is this compliant with the Trust in Caller ID Act of 2009? Yes, when you in fact own the rights to the number you are calling from.

There is an active discussion going on in the Member Forums here at MedicareAgentTraining.com where agents are sharing their solutions to this issue.

Come see this discussion going on now in the member forum!

Click here to read on

Click here to read on AHIP Sees 28% Increase in Medigap Enrollment Among Seniors

2017-05-05 06:06:30Medigap enrollment increases as out-of-pocket expenses rise for seniors due to holes in Medicare coverage.

Source: https://healthpayerintelligence.com/news/ahip-sees-28-increase-in-medigap-enrollment-among-seniors

Reflecting on how I got here

2017-04-24 06:24:45 Click here to read on

Click here to read on Avoid Shiny Object Syndrome!

2017-03-03 15:48:38

Many of us are guilty of constantly seeking the next “shiny object”, thinking that it will be, finally, the solution to easy profits with MUCH less effort.

While there is a lot to be learned from attending seminars, buying courses, and studying non-stop, there is a point where a successful person stops searching for the next-great-thing,and actually goes to work.

When you find yourself circling about to the things you've already seen before, and YOU have not implemented anything, it's time to look in the mirror and make a decision. Which way are you going to go?

Click here to read on

Click here to read on Why Medicare Agents Fail

2017-03-02 12:24:27

Having worked with thousands of agents now, the pattern is perfectly clear.

Agents choose to fail or they choose to succeed. The key is, it's a choice.

That's what I covered in this SeniorAgentPodcast episode.. you can listen here:

Resources:

Medicare & You Guidebook Online

Medicare & You Guidebook PDF 2017

Click here to read on

Click here to read on Question 3: How much money do I need to get started?

2017-02-10 22:01:53How much money should you have saved before you go all in? That's the subject of this Q&A. The good thing is that it does not take much money. The bad thing is, also, that it does not take that much money to get started. A smart business person will start the enterprise having a backup nest egg of savings to carry them through the initial start-up phase. <

Question 2: Should I stay a road warrior or start selling by phone?

2017-02-08 22:08:14This agent wrote in that he was getting frustrated with the lack of available data in his community for his telemarketing campaign. The problem was that he was insisting on keeping everything LOCAL. He removed the upper-age limit on his data, just to have someone to talk to, so he was getting 90 year old folks interested in a new Medicare Supplement.

HIS QUESTION:

“I would like to continue to work face to face sells and he shared with me that's what he did with his first telemarketer. Expanding out will not work under that premise. Staying within driving time keeps me from getting much farther away.

But what do I do now? Can I go in and reload a larger territory in the middle of a calling campaign? Will she be calling some of the same people again? I'll give anything a try. I'm already invested. “

Question 1: When is the right time to hire help?

2017-02-08 21:08:00

When should you start hiring help? Should you first hire another telemarketer, a general assistant, or a licensed agent to help you?

These are the questions asked in this first edition of the video Q&A.

The only way to know if you're telling the truth

2017-02-05 22:33:46Yes, it all still works.

See the short video:

<2 Lessons in Marketing

2017-02-03 08:20:33Excerpt from https://www.salesgravy.com/sales-articles/automotive/five-lessons-i-learned-at-starbucks.html

“Lesson #1 – Make sure you ask for the business. I have just watched a beggar collect at least $5 worth of donations in the last half hour with a sign that says – “I am saving up for a hooker, weed, wine and a steak dinner.” Not one of the people bothered to read his sign and know what they were even donating for. Not the family man with his wife and children, not the group of older people probably in their 80s, not the business man in the suit, nobody. The beggar obviously learned the power of asking, no matter what.

Lesson #2 – It’s not the money. People pile into Starbucks one after another spending three and four bucks on of a cup coffee. Obviously you can get a cup of coffee at a diner down the street for a lot less money. But yet, people willingly spend a $100 per month or more at Starbucks. Why?

People are buying the experience and the perception of the brand. I am sitting here writing this article in a busy Starbucks and people watching when I could be in the quiet and seclusion of my nice hotel room. The person in the seat next to me is listening to music on an iPod when they could obviously do it for free in the Square with a less expensive cup of coffee. The gentleman in the big living room type chair is reading a novel. People want the experience. Understand your customer and the value they want and the money will become less important. The big three U.S. auto manufacturers give huge rebates, and imports are still kicking their butts. It’s not about the money.”

I'm always surprised with agents who are failing at business discover that it was because they were not asking for the business. They would present options and then just leave it, never politely suggesting that the client move forward with an application.

And, if you feel the product costs too much, it's too hard for them to sign up online with you, or it's crazy for you to ask for their personal information over the phone – so will they. YOUR objection will become their objection. It's true! You have to be convinced, first, that the sale is in their best interest. When you are convinced, get out of your own way – ask for the sale and deserve it and you'll have it.

Former Cop, Now Medicare Agent. Why?

2017-02-02 18:26:18The reason I picked this niche of insurance was two-fold. One, I could work with a great generation of people and help calm their fears about their next transition in healthcare and, two, I could create a residual income for my family.

Both have come true, and it's the most amazing thing that 10 years ago I would have never believed possible. In this video, I talk about a police officer in Mount Pleasant, SC I met today (Doug), and our conversation about what starting officers now make.

Guess what? It's about the same that we made starting 10 years ago. That is absolutely crazy. I do not know how anyone can raise a family on a salarty like that, and it's totally wrong.

I told Doug that if he ever has had enough of the politics, chaos, and public resentment now happening against law enforcement, he can look me up. I'm easy to find online!

It is my sincere wish that all of the good guys, and ladies, that I used to work with could now be enjoying this lifestyle with me. It'd be even more fun! – Christopher Westfall

Work from home or move into a new office?

2016-12-05 09:34:26A question was recently asked, “Should I get an office or work from home as I'm starting to grow and it's obvious I need admin help already?”

I was still a one-man show when I rented my first EXPENSIVE office in a Regus complex in Lake Mary, FL. It was an investment in appearance for the clients, which never once came because I sold over the phone, and an investment in accountability of having somewhere to SHOW UP every day. This was the key for me.

When I started working with someone else, knowing that they were going to show up, so I had to show up, created a very productive environment for both of us. I would swear to you that business really began taking off as a result of that simple move. It was great to be around other productive people that were showing up every day to work.

I know you don't have this problem and laziness/accountability are not factors in what you're asking, but if you're ever going to grow to 5 or 10 employees or 100 if you so desire, it is going to happen sometime, anyway, and I would argue that it is best to build it before you need it. Create the envelope bigger than you need and then you will find a way to fill it.

Now looking to move offices for the third time due to growth, I know that if I had not stepped out in faith to get outside of my home office, I would never have been where I am today. Why? Because it was comfortable; it was TOO comfortable to work from home. Yes, it's cool to be running my own company, but I knew early on that I could not grow enough on my own.

Having a remote admin assistant did not work for me. When I had someone working next to me, who heard everything, then started repeating the answers I gave to the people they were then talking to, it created a synergy that has now replicated over and over again.

In my office now, someone will say something that's a great answer and then the others will start repeating it and a best practice is born. That cannot happen with remote folks. – my two cents. –cw

Stop Being Needy = Increase Sales

2016-11-16 14:05:36Having been asked to listen to recordings of hundreds and hundreds of agents getting started in selling by phone, one common theme has held many back.

Brett Kitchen, in this video below, talks about this problem when selling over the phone and how to address it. I call it “practice it until you perfect it.” Others call it, “Fake it 'til you make it.” Either way, you have to be aware of the potential to sound TOO interested in the sale outcome and you have to know what effect it has on people.

Brett's group sells IUL (indexed universal life) products by phone to high-income individuals using radio ads.

No matter what you sell over the phone, this issue can be a problem! They can hear desperation through the phone!

And remember what Mike Brooks says in the Top 20% Webinar series (at the bottom of this page), “A bad lead never gets better.” Move on from angry, disgruntled, difficult people!

Medicare Advantage for Turning 65

2016-09-26 06:33:24Approximately 30% of Americans turning 65 are opting for a Medicare “Advantage” plan. In my experience, this most often happens for the following two reasons:

- They have been relatively healthy up to 65 years old

- They believe this great health will continue into their senior years

- Medicare Advantage plans at $0 per month can be quite attractive

- They miss, or minimize the often $6,700 Maximum Out-of-Pocket PER YEAR

Sadly, there are many situations that we have seen where a Turning 65-senior has chosen one of these “free” Medicare Advantage plans only to have to experience the limitations and large hospital admission co-payments by having a serious illness that takes them into full usage of their chosen plan.

When they were first turning 65, they thought their great health would continue far into their senior years, only to discover that this is the time frame where most all medical claims are experienced in life. Sadly, when they signed up for a Medicare Advantage plan, particularly an HMO plan, they find that the restrictions now imposed on them, the trade off for little or no monthly premium, now can significantly and adversely not only affect their availability of specialty care (replaced with tight networks) but also expose them to more money spent for medical care than their non-“Advantage” plan senior counterparts.

On the contrary, the biggest proponents of Medigap (Medicare Supplement) plans are those who have had to use them with a serious illness. For example, those with a special kind of cancer who can now choose the best cancer treatment centers in America without consequence because their Medicare Supplement plan allows them to go anywhere. Those who would have otherwise been exposed to a $6,700 out-of-pocket cost with their Medicare Advantage plan for a series of hospital admissions who though, because on a SUPPLEMENT plan instead, pay $0 for their admissions and, more importantly, get to CHOOSE their hospital instead of only being able to go to the one that was the lowest bidder that joined the “Advantage” plan's restrictive network.

In an illuminating article by the non-profit Kaiser Family Foundation, the choice of a Medicare Advantage plan when a senior is turning 65 can prove disastrous for future healthcare choices for the rest of a senior's life. See the article here:

http://kff.org/medicare/perspective/traditional-medicare-disadvantaged/

It is very important that now-Medicare-eligible seniors have the full information on the good, the bad, and the possible devastating effects of picking their Medicare plan.

Chris Westfall is an independent Medicare agent and has been a licensed insurance agent for over 20 years.

New Requirement for MAPD Sales

2016-07-13 07:02:55Do you sell Medicare Advantage plans or Part D plans?

If so, in addition to the AHIP test, there is now another, separate test administered only through CMS and it is required.

This test is on Waste, Fraud, and Abuse, as there always had been in the AHIP test already, but now it's required separately.

Courtesy of United Healthcare, this is a link to the instructions as to how to find and take this simple test:

Click here to read on

Click here to read on Cross Selling Brings BIG Money per Case

2016-05-27 17:21:03Instead of a case that would pay $269.69, this video shows how the commission, first year, is $1,067.70 because CJ asked told of the availability of the cancer plan. He asked about heart attack/stroke coverage, and he asked about life coverage.

This sweet lady was used to paying $700 per month for her employer plan that had restrictions, networks, and co-pays. Now, she has a MUCH better plan (Plan G), lump sum coverage for Cancer, Heart Attack or Stroke, AND permanent Life Insurance coverage locked in now at the age of 64.

The is in a much better position, fully covered, and happy with her new security and price.

See the video:

Perfect example of a great cross sell.

CIGNA's electronic application makes this point and click easy without having to re-enter the client's information again in multiple applications.

Decades ago, companies like McDonald's learned that if you merely asked, “Would you like fries with that?” that a significant amount of people WOULD. Their profit is all in the extras..just like the movie theaters. They make nothing on the ticket sales. It is all on concessions.

This is good coverage, provides peace of mind, and because of a process like this, helps the agent to make additional income by taking care of clients in a meaningful way.

Learn how to sell cancer policies, etc. at:

http://MedicareAgentTraining.com

Why more agents are getting into Medicare

2016-05-10 10:25:07Many friends and relatives have been contacting me recently to ask more about the business I’m in. Why? For a variety of reasons including, but not limited to, their changing life circumstances where they may be seeing change ahead or no progress where they currently are.

More, though, are seeing the lifestyle that this business can afford those who have put the time in to build a residual income business by helping people, and they want more of that in their lives. This is, perhaps, the best reason because I firmly believe that if you want something bad enough to trudge through the unpleasant parts of getting there, you will absolutely have it.

In the last 30 days, my wife and I have traveled to Rome, Italy (with Mutual of Omaha’s Sales Leaders trip) and to Iceland with Aetna. We will soon be taking another trip to Vancouver, BC with yet another insurance organization and then I’ll be going on to a “mastermind” event in Alaska just before the busy season begins yet again.

What happened in Iceland in 2016

2016-05-07 13:46:33The first week of May, Chris and the other top 150 or so Aetna agents, and their guests, were in Iceland for the production award from 2015. Many on this trip, including Chris and his wife, Nicole, had just returned back to the states from Rome with the Mutual of Omaha trip just less than two weeks prior. It was a quick turnaround for another out-of-the-country adventure.

The weather was cold, mostly due just to the incredible wind in Iceland, but the camaraderie forged between new friends made the trip a priceless gift. Sharing ideas and various business practices with the folks there just proved, once again, that it all works.

Just like the Rome trip, Chris met with many agents and discovered that what they were doing was working just as well. Whether it is direct mail, a phone room setting appointments, or agents dialing for their own leads on a predictive dialer, it is all working. Some were there because they do seminars. Some just get lead lists of T65 folks and go “door knocking”. Still others hire in-house telemarketers to find interested folks. It all works. That was the biggest point.

While on this trip, Chris was greeted about around 10 agents throughout the week that came up to introduce themselves. They were members of MedicareAgentTraining.com and had found the site valuable in their business. This was very humbling and had continued from the week prior, at the National Medicare Supplement Conference in Kansas City, where this happened approximately 50 times. It was great for Chris to be able to meet members and others from the Medicare community who he might have only seen online as their black and white username!

One of those that came up to Chris in Iceland was 20 year old Bridge.

Bridge sets his own appointments, using the predictive dialer. As one of the winners of the Aetna trip, he is obviously doing very well in the business. He sat down with Chris and talked about this, and how he just got his 19 year old cousin to get into the business with him recently. His cousin, who just turned 20 now, sold six policies this week on his own, the week that Bridge was in Iceland with Chris and the Aetna crew.

See Bridge tell the story:

This is a quick video Chris did about Iceland that relates to the Medicare field:

Photos Chris and Nicole took on the 2016 AETNA trip to Iceland:

Providing Value vs. Providing Products

2016-04-22 09:12:26What is it that you are communicating?

If you are communicating to the senior market that you have Medicare products, guess what?

Every other agent in America also can sell Medicare products.

What is it that you are bringing before you are asking for them to buy?

Are you providing valuable information that they can use or do they feel that the entire conversation is geared toward driving them to a sale?

It has been often quoted that people want to buy, they DO NOT want to be sold. They make their decision emotionally, based on what has been provided, and then justify that decision, later, logically. By merely providing yet another channel where someone can buy, without first providing value, you are just like every other salesperson out there and nothing separates you from what anyone else can do.

A recent survey conducted by Hubspot shows that people want to be provided service FIRST, as the most important deciding factor before they make a buying decision. This should not be news, if you examine who you, yourself want to buy.

When my wife and I were in Rome recently, we watched in awe as these young boys were on the steps to a thousand+ year old monument, attempting to sell their wares. What they were selling where 11×17 inch replica water colored paintings of the various monuments around Rome. These same replica paintings were being sold on many street corners, but these boys were very creative, and it showed.

What they did differently was that one of the boys had a coloring pencil in his hand, and a variety of colored pencils at his feet. He sat on those steps and appeared to be just finishing the next painting, himself. He appeared to be putting a lot of attention into the detail of what he was working on, as the other paintings were surrounding him on full display. This gave the illusion that HIS paintings had all be hand-done and had been created meticulously with care.

To the passing tourists, what appeared to them was that they had an opportunity to purchase custom artwork of Rome, drawn right here on the steps of one of the monuments. How unique and valuable!!

While these two kids were selling the exact same thing as everyone else, they created the perception of unique value that their particular paintings brought that other similar paintings in the area did not have. With the other unmanned displays, folks were just buying copies. With this one, they bought value.

In a similar fashion, many top producers in the industry have shared with me the various ways in which they paint the picture of unique value in the mind of their potential consumer. Whether it is researching drug plans for their clients, or promising an amazing amount of follow up, they attempt, at every turn, to separate themselves from the agents who merely provide only an application and a policy delivery.

Agents who make no attempt to separate themselves and their business from the competition will be bland, boring, and will reap the rewards that befall nothing interesting.

CW

What's on YOUR wall?

2016-04-21 10:56:00Had this question today by support ticket:

When I dealt with ACA Obamacare, I had a bunch of pin ups next to my desk that had common carrier phone numbers, sales dialers account info, Plan outlines, etc. Just a bunch of random semi helpful stuff that I was able to reference time to time.

My question is, what do you have pinned up next to your desk that you reference from time to time. I noticed you have a time zone map, I see how that would be really useful for calling in other states and setting appointments. But what other stuff do you have pinned up next to your desk, I wasn't able to tell from the video?

I know you're a pretty busy guy, and out of all the questions I could have asked you, I ask what you have pinned up against your wall. I guess your videos have been thorough enough to answer all my other questions!

Here's my video reply:

Final Expense Training

2016-04-18 17:18:16It is with great pleasure that I highly endorse a new book by David Duford called “The Official Guide to Selling Final Expense Insurance.” Dave's book is selling on Amazon now and a portion of the proceeds is helping another agent friend, Mark Rosenthal, with his very expensive disease treatment. Buying this book is a “no brainer” and a true win/win.

David Duford has proven himself to be a powerful influence in the final expense industry in the past few years. Not only is he a successful agent in his own right, he has a teacher's heart and enjoys helping new agents to find success in the Final Expense niche. This book is very well done and will be a resource for FE agents long into the future.

I highly recommend agents in, or considering, the final expense life insurance niche to pick up this valuable guide.

You can do so here.

Chris Westfall

Final Expense or Medicare Supplements?

2016-03-15 14:04:33A new agent came by our office and was asking whether or not she should pursue the final expense market or the Medicare Supplement market.

My son was nice enough to catch part of the conversation on his cell phone.. here's the end of the final expense part, which was that those folks are at the lowest end of the socio-economic scale, often never having thought of having life insurance before, and often having had horrible money management their entire lives and NOW they want YOU (the agent) to solve this with a brand new policy they promise to pay for, every month, for the rest of their lives; or

replacing or helping someone with a Medicare Supplement policy that they either already had or were already going to buy and would never, ever, be without AND have the means to make those premium payments, forever.

See the conversation:

Fortune Favors the Bold

2016-02-24 19:32:56Fortune Favors the Bold

This old saying is so true about those adventurous small business owners, like us, who start every day boldly helping others and building our individual fortunes in the process. <Your Personal Credit and Starting in the Insurance Business

2016-02-18 15:20:09What does your personal credit history have to do with starting, or not starting in the insurance industry?

A lot.

See the video:

Help Others, Help Yourself, in the Medicare Business

2016-02-08 14:38:08Supporting our families by helping seniors with their Medicare plans!

This is a great business to be in!

In this video, Chris shows his Monday morning mail, where he was notified by Aetna that he won a Holiday Helper Bonus from the last quarter of 2015.

That bonus was $4,300! It was totally unexpected and just from doing the right thing by our clients.

This bonus, and the trips, are only from personal production. None of Chris' sub-agent production counts toward the trips or the bonuses.. just his own business.

What a great career, where we are rewarded handsomely by helping people.

A/B Split Tests in Life

2016-02-06 09:57:23The A/B Split Test, and Life

I don't know why it is, but I always seem to have my breakthrough thoughts – in the shower. Why is that? I've given up trying to figure that one out.

For years I've studied personal development and internet marketing. I am confident that doing both has resulted in my business success, which is a whole world away from 10 years ago when I was a sheriff's sergeant working 12 hour shifts and always having to live paycheck to paycheck.

What had to change was, me.

What I learned, by first identifying mentors and then changing HOW I processed the information that I saw in front of me, I could start to change the results in the time I spent working on my business.

It was not enough to merely focus on the cold calling, the follow up, the company's E-App, and Steps 1, 2, 3; I had to change how I saw my business in an effort to serve others and – very, very importantly, how I dealt with the challenges and frustrations that come with ANY business venture.

Last week, my agent training membership site hit 2,000 members at the site's 3 year anniversary.

In that time I have received countless success stories from agents saying that the site's information has changed their lives, provided freedom from a J.O.B. (just over broke) and put them on a path to financial freedom.

But, sadly, too, I have experienced the communication from agents who've said that they are giving up, did not achieve immediate successes and, without enough positive results to their satisfaction at that point, they're throwing in the towel. They went back to hourly jobs, working for someone else, because they could not make it work..not successful enough for their markers with the time they'd chosen to invest up to that point.

I know, beyond a shadow of a doubt, that it is not for a lack of information, companies available, training, or product education. It is because of an internal inability to process the negative experiences that are inevitable in business.

When the rejection comes, and it will, how do you process that?

When you successfully help a new client and they express how thankful they are that they met you, how do you internalize that event?

Hear me LOUDLY here.. Whichever one of those you CHOOSE to focus on will drive that future outcome and you will experience more of what you have chosen.

If you have two plants next to each other and water one, without watering the other – one will grow and one will slowly die. DUH, right?

The same, exact scenario unfolds in our business when we CHOOSE to focus on what just happened with the 80/20 rejection that is inevitable in any business.

A focus on the negative result WITHOUT a celebration and internal reward on the GOOD result causes more of the negative outcome. You will, always, experience more rejection than success in any business. Are your expectations balanced to adjust for that? You must compensate for this inequity by making a HUGE focus on the gains and putting those front and center in your mind when you decide each morning -“What am I thankful for??”

This behavior is a choice. It is not natural. It is focusing on the seed, which grows, rather than the storm that it finds itself in. It takes a conscious decision, each and every day as to how you are going to start it.

Call centers that I have consulted for often have a big, huge bell in the middle of the room where all of the callers are working. When a worker there makes a sale and writes an application, they get up, walk over, and RING THAT BELL.

Why do they to this? Because it is proven that rewarding the great result, while choosing to accept the NATURAL negatives that happen along the way is the best path to long term success. Keeping one's head down, following a proven system, and working UNTIL the success is evident to everyone around you IS the secret.

When they are rejected, or when a client decides to take his or her business to someone else, do they go around the room and spread the rejection? NO. Why?

So, back to this morning – in the shower I suddenly realized that the personal development skills I have made into habits line up perfectly with the online marketing I've been doing, with the A/B Split Test.

Given the feedback of the day/week/year, which direction are you going to go?

Please watch this short video. I hope you are encouraged and I hope you make the choice to guard your thoughts and guard your emotions.

You are in solid control of where you choose to go in your own head.

This is no trivial thing. The best system in the world will not work if your QUIT/DON'T QUIT threshold is set too high and focused only on the losses along the way.

My wish for you is continued success and continual breakthroughs. For you, it should not be a wish, though, it should be a plan that you work until it happens.

The system works, absolutely.

The question is, will you stay around long enough for it to materialize in your life.

I think about you (members) daily and want you to succeed.

Sincerely,

![]()

MedicareAgentTraining.com

How to Mail Policies to Clients

2016-01-25 21:23:16When Chris Westfall mails policies to clients (which is required in certain states like LA, WV), he does so in a “priority express” envelope that gets special treatment/perception by the client, but costs no more than first-class postage. These envelopes do not require Priority or Express postage – mere first class stamps!

See the video explanation:

You can get these priority/urgent envelopes here:

http://3dmailresults.com/product-category/express-envelopes/

Chris and Son to Speak at 2016 Medicare Supplement Conference

2015-12-23 09:20:12Both Chris Westfall and his 21 year old son, CJ, will be speaking at the 2016 Medicare Supplement Conference in Kansas City Missouri in April.

CJ, who has had his license for less than one year, will be talking from the stage on what he learned that helped him to write over 300 polices to seniors during his first year.

Topics CJ will Discuss:

What kind of obstacles did he have to overcome?

How did he learn to communicate effectively to seniors 50+ years older than he is?

Chris (Sr.) will be giving an 18 minute talk on the importance of developing social media avenues to generate incoming leads.

Chris' agency only takes incoming calls now, all from free social media platforms that he has studied intensively and he will share some of those discoveries with the conference attendees.

The first day of the conference, Monday April 25, is free.

The rest of the conference (Tuesday and Wednesday) are not free but are packed with information that agents can use.

Chris will be attending the whole conference and will be reporting back to the members of Medicare Agent Training.com.

For information on the 2016 Medicare Supplement Summit in Kansas City, click here.

Best Practices with Lead Responses

2015-11-24 09:36:09This infographic from InsideSales.com tracked the best practices when responding to leads.

They are primarily talking about internet leads and the impact of an immediate response, then follow-up with that lead through the sixth attempt.

Look at how few salespeople will actually try past three calls with a new lead!

It also covers the best time of the week and the best time of the day for success in reaching leads effectively.

Podcast on: Stop Wasting Time (by doing busy work)

2015-11-20 12:43:57Over the years, Chris has learned the difference between just being busy for busy sake vs. doing things that will achieve the best, possible results for our time investment in this business.

Many agents still believe that writing applications all day is their only mission, and they'll write an application on anyone that says, “Yes.” Those anxious folks that are very eager to get going with you should be the ones you spend the most amount of time trying to find out why they are disqualified from the beginning.

The art of asking the right questions, in this case – all of the health questions, before moving into an application setting AT ALL, is critical if you want to have enough time to spend with those that are qualified.

AT&T Retiree - AON Medicare Update

2015-11-18 17:19:13This is a public video that Chris Westfall put out about the latest with the AT&T use of AON for retiree Medicare benefits.

For members, see the full coverage of the opportunity to help AT&T retirees, including necessary documents and reimbursement procedures by going to this link.

Click here for the Members-Only AT&T Retiree Info

When Prospects Don't Have Time For You

2015-09-29 07:09:30Seven Things to Say when Prospects Don’t Have the Time for Your Presentation

We’ve all been there – you call your prospect back at the appointed time for your presentation and they tell you any of the following:

This isn’t a good time, OR

They only have a few minutes, OR

They ask you in an exasperated tone, “How long will this take?” OR

They tell you they have a meeting in 10 minutes, can you give them the information anyway?

Or any other put off that will cut short the 30 minute comprehensive presentation you had planned.

Most sales reps respond to these objection-like receptions by asking if they would prefer to set another time. That response might be appropriate with the first put off – the “This isn’t a good time,” – but with any of the others, I have a better technique for you.

Let’s start at the beginning. First, when you get this kind of response from a prospect you qualified a week or so ago, don’t be surprised! Face it: it’s a law in all sales – Leads Never Get Better! If you sent out the hottest lead ever, a “10” on a scale of 1 – 10, then when you call them back, have you ever noticed that now they’re about a “7”?

And of course since most sales reps don’t qualify thoroughly enough, most of the leads they stuff into their pipeline are made up of sixes and sevens. And you can imagine how they are when reps reach them. So expect that your leads are going to drop in interest and receptiveness when you call them back, and then be prepared with a best practice approach to handling them. Here’s what to do:

Whenever a prospect responds to your call to do a presentation with one of the responses above – the “How long will this take?” – kind of response, don’t offer to call them back later, rather, get them to reveal their true level of interest to you and get them to tell you exactly how to pitch them to get the deal. Here are a number of statements you can use to do just that:

Responses:

“Sure, I can take as long or little as you need. Let’s do this: why don’t you tell me the top three things you were hoping to learn about this, and I’ll drill right down and cover those areas for you. What’s number one for you?”

OR

“Absolutely, we can do this pretty quickly. Tell me, what would you like to know most about how this might work in your environment?”

OR

“I understand, sounds like I caught you at a bad time. Let’s do this: If you needed to see or learn just one thing about this to determine if it might actually work for you, what would that be?”

OR

“No problem. Our presentation is pretty in depth, but I can do this. Go ahead and tell me two things that are absolute deal breakers for you, and I’ll see if we pass the test. And then if we do, we’ll schedule some more time later to go into detail on how the rest works, fair enough?”

OR

“In ten minutes, I can show you some things that will help you determine whether or not you’d like to spend more time with me later. In the meantime, let me ask you – what would you need to see the most to say yes to this?”

OR

“I understand, we’re all busy. Let me just ask you: has anything changed from when we last spoke?” (Now REALLY listen…)

OR

“Tell you what: let’s reschedule something for later when you have more time, but in the ten minutes we do have, let me ask you some questions to determine whether this would still be a good fit for you…” (Now thoroughly re-qualify your prospect)

As you can see, the responses above are all aimed at getting your prospect to reveal to you both their level of interest and what it is going to take to sell them – or whether or not they are still a good prospect for you. Have some fun with these; customize them to fit your personality or the personality of the person you’re speaking with. Find your favorites and then, as always, practice, drill and rehearse until they become your automatic response when your prospect tells you they don’t have time for your presentation.

Reprinted from Mike Brooks:

http://mrinsidesales.com/insidesalestrainingblog/seven-things-to-say-when-prospects-dont-have-the-time-for-your-presentation

Getting started selling Medicare Supplements by Phone

2015-08-24 15:30:25Chris Westfall on getting started with Medicare Supplements

Over 200,000 seniors are turning 65 each month in the United States. This is a HUGE opportunity for those agents who know how to get in front of this “silver tsunami”!

In this podcast, Chris Westfall talks about marketing to seniors using various methods and what he has learned since getting his insurance license in 1995 up to today.

What you MUST do before starting in this business

2015-08-21 02:31:39From SeniorAgentPodcast.com.. click the play button below.

What must you do to be successful in this, or any other business?

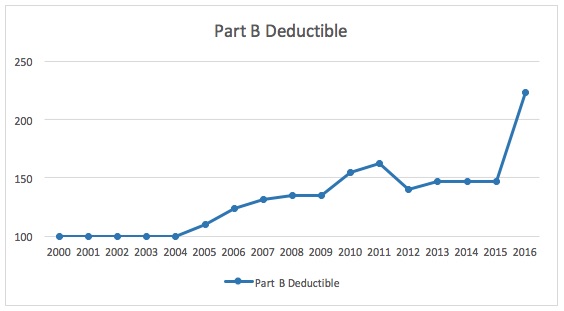

Potential Changes to Part B

2015-07-31 09:45:18The recent report by the Medicare trustees is currently being evaluated by HHS Secretary Sylvia Burwell, who is expected to make a final decision October 2015 to impact Medicare beneficiaries in 2016.

The trustees recommend increasing Part B premiums charged to seniors monthly some 52% starting in January 2016. This would mean going from $104.90 to $159.30.

The report states that this would impact 30% of all Medicare beneficiaries and would be again tied to their income, targeting those with incomes over $85,000.

The other, more impactful recommendation is a change to the Part B deductible to $223 instead of the current $147. This would impact ALL Medicare beneficiaries and is sure to cause outrage by the senior lobbyists on K street. There will be much pushback to such an increase.

CSG Actuarial is analyzing the impact on carriers and on seniors with Plan F and Plan G. The initial analysis is that the Plan F rates will, after accommodating for the higher built-in cost in the premiums of Plan F which will absorb the new Part B deductible, need to increase 4% due to more claims. Plan G, however, would see less claims and actually justify a rate reduction. How carriers would choose to implement the change is still up in the air.

We will continue to monitor this recommendation's impact on seniors and whether or not it will be adopted.

Stay tuned!

-Chris Westfall

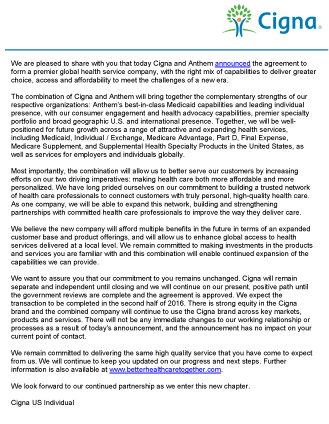

It's Official: CIGNA and Anthem to Merge

2015-07-24 17:14:40Today it was officially announced that CIGNA and Anthem have struck a deal to become, for now, the largest health insurer in America. The terms of the final deal finally having weathered the storm of a two-month long negotiation, the deal is said to be worth $48 Billion to CIGNA for its acquisition into Anthem.

The independent market is still waiting to hear how this will impact the Medicare Supplement and Medicare Advantage distribution channels. The deal might take two years to get through regulator's approval.

As always, we'll have the specific news when it's available as to how this will impact the individual agent. – Stay tuned!

-CW

See the announcement:

Pausing Your Success - Telemarketing Tips

2015-07-11 10:25:12How much should you charge for Medicare advice?

2015-07-07 07:53:14Independence is not just a day, it's a lifestyle.

2015-07-04 13:17:21 Click here to read on

Click here to read on Thoughts on Hiring an Assistant

2015-06-12 17:17:38Here's a quick video message from Chris Westfall on considerations as to whether or not to hire an assistant..

See the video:

Direct Mail for Medicare Supplements Sold by Phone